Linkedin Feed

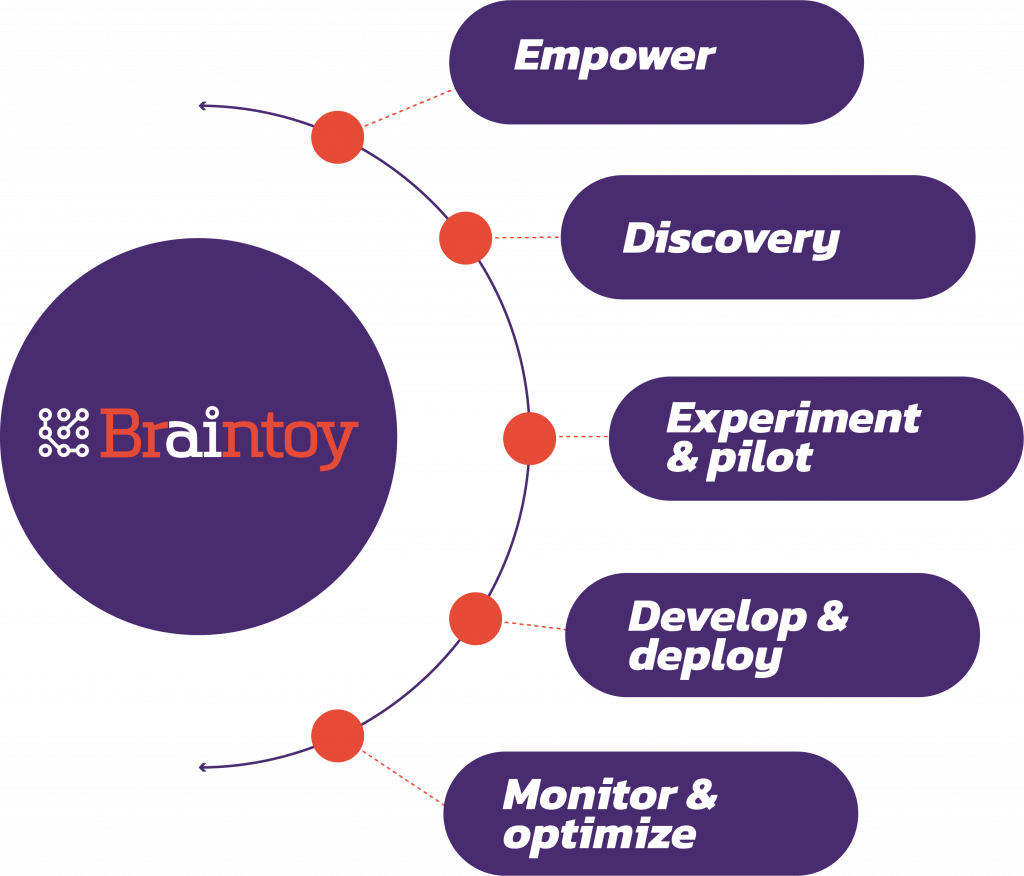

Your FASTEST Way to a Working AI Solution with MLOps

Dive into the future of #AIinnovation with Braintoy!

🌐 Join us now at The Silicon Valley Summit, where our booth is buzzing with the marvel of AI technologies. 🤖✨

Exciting News from #Braintoy!

Join us this December at The Silicon Valley Summit for a front-row seat to the future of #AIinnovation. 🤖✨ Explore with us as we unveil the magic of AI technologies and share how Braintoy is transforming business strategies across various industries.

Exciting news! 🚀

Braintoy is thrilled to be part of the innovation showcase at the Plug and Play Alberta Health EXPO and Sector Agnostic EXPO on November 30, 2023. Join us for a day of cutting-edge tech pitches, insightful discussions, and networking opportunities with industry leaders. Let's dive into the future of AI, Machine Learning, IoT, and more!